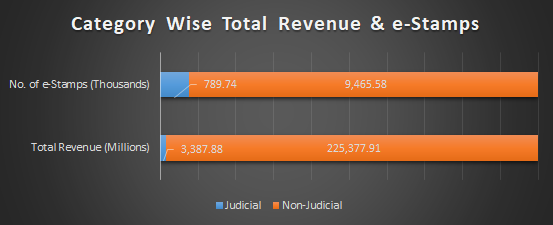

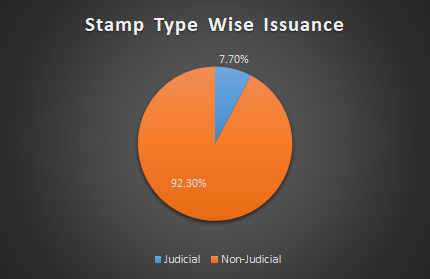

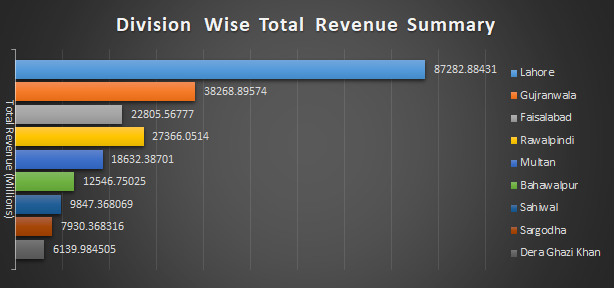

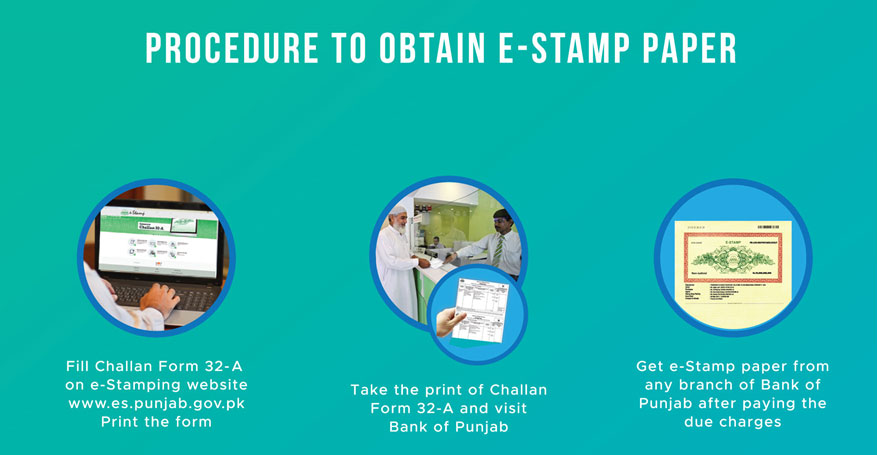

Collection of stamp duty is a major own-sourced revenue for government of Punjab. It is collected by Board of revenue. The centuries old process had major issues pertaining to citizen facilitation like leakage of revenue through fake and fraudulent practices. PITB’s e-Stamping system has completely revamped the stamp issuance process which once used to take at least two to three days, has now been put online by PITB so that anyone wanting to purchase high value non-judicial and judicial stamp papers can do so by using a computer with internet connection. The value of the stamp duty is calculated on the basis of data provided by the buyer (such as land area, location, covered area, commercial / residential status etc.). The DC valuation tables have been built into the system. Name of buyer, seller and the person through whom stamps are being purchased are entered into the system along with their CNIC numbers. PITB has also built a central database for e-Stamping system which has made the verification process easier for citizens. Training of sub-registrars, stamp vendors, deed writers and other relevant stakeholders have been conducted by e-Stamping project team. A mobile app has also been developed for auditors so they can easily verify e-Stamp paper and Challan-32-A.

Collection of stamp duty is a major own-sourced revenue for government of Punjab. It is collected by Board of revenue. The centuries old process had major issues pertaining to citizen facilitation like leakage of revenue through fake and fraudulent practices. PITB’s e-Stamping system has completely revamped the stamp issuance process which once used to take at least two to three days, has now been put online by PITB so that anyone wanting to purchase high value non-judicial and judicial stamp papers can do so by using a computer with internet connection. The value of the stamp duty is calculated on the basis of data provided by the buyer (such as land area, location, covered area, commercial / residential status etc.). The DC valuation tables have been built into the system. Name of buyer, seller and the person through whom stamps are being purchased are entered into the system along with their CNIC numbers. PITB has also built a central database for e-Stamping system which has made the verification process easier for citizens. Training of sub-registrars, stamp vendors, deed writers and other relevant stakeholders have been conducted by e-Stamping project team. A mobile app has also been developed for auditors so they can easily verify e-Stamp paper and Challan-32-A.

|

|

|

|

|

|

|

||